Inflation – Is There A Silver Lining?

Inflation is set to reach double figures this year. Is there a silver lining behind the looming clouds? Mark Ashbridge illustrates how clients can make inflation work for them.

High Inflation – a new experience for most people

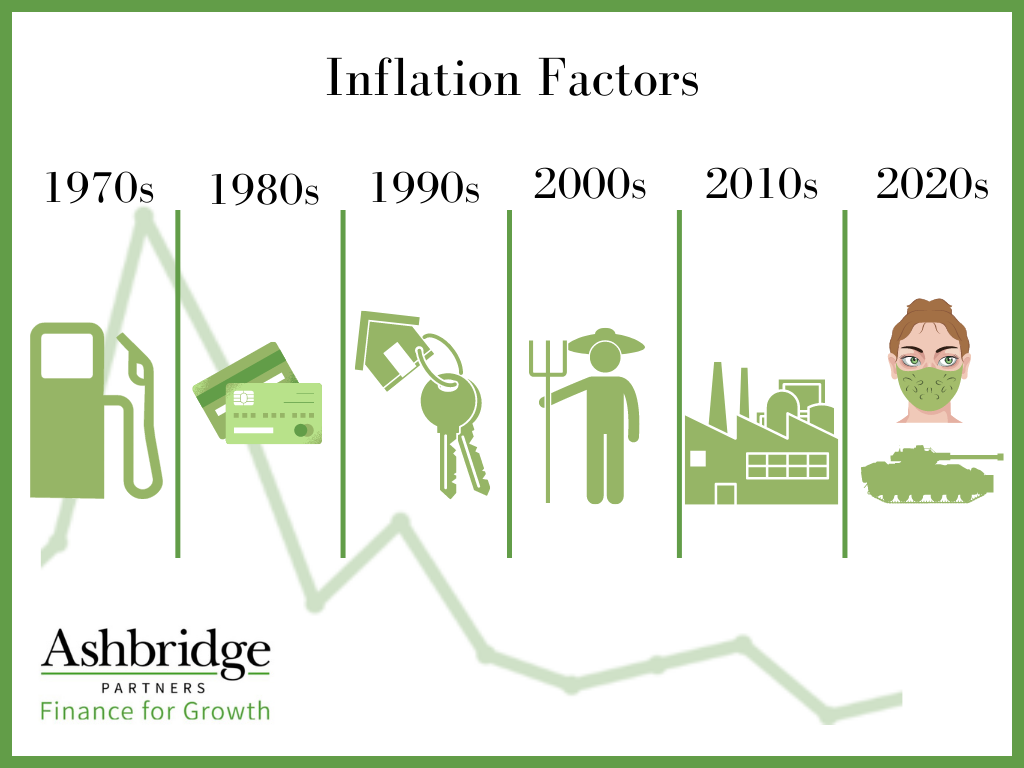

Inflation is forecast to reach 11% later this year*. For those in their early 50s and younger, this is a new experience, and the media is already making comparisons with the 1970s. With forward planning in mind, it may help to look back before moving ahead. (*BoE)

Inflation 1970s – oil shock and power cuts

Those 60 and older will remember the oil price shock of the 1970s – extraordinary levels of inflation, a stagnant economy, power cuts, and the three-day week. The UK was known as “the sick man of Europe”.

However, many of today’s property fortunes were created as a result of the opportunities that arose during and after the 1970s.

Hold that thought. We’ll be coming back to that.

1980s and beyond – the evolution of mortgage and credit

The 1980s brought with them Margaret Thatcher and the ‘big bang’. Our financial markets opened up to foreign competitors and American banks stepped in. For the ordinary man on the street, this opened up access to a wider range of financial products. By the 1990s, competition between lenders was driving innovation such as ‘buy to let’ mortgages. Other forms of credit were introduced – credit cards, personal loans and vehicle finance. The nation has now grown to expect competitive finance availability for all, subject to the usual caveats of a clear credit history and the income to support it. Our attitudes towards debt have changed.

The new millennium – was low inflation just a blip?

Economists will conclude that the last twenty years were the perfect recipe for low inflation and low interest rates. We had a never-ending flow of Eastern European workers to keep wages under control, and much of our manufacturing moved overseas to lower cost countries, with China in particular keeping costs low.

However, Covid-induced supply issues, and the recent impact of the Ukraine invasion, have highlighted significant risks around the supply of food and essential materials. Governments and consumers are now more willing to pay a premium for security of supply.

Cue inflation’s perfect environment.

An educated guess for the 2020s?

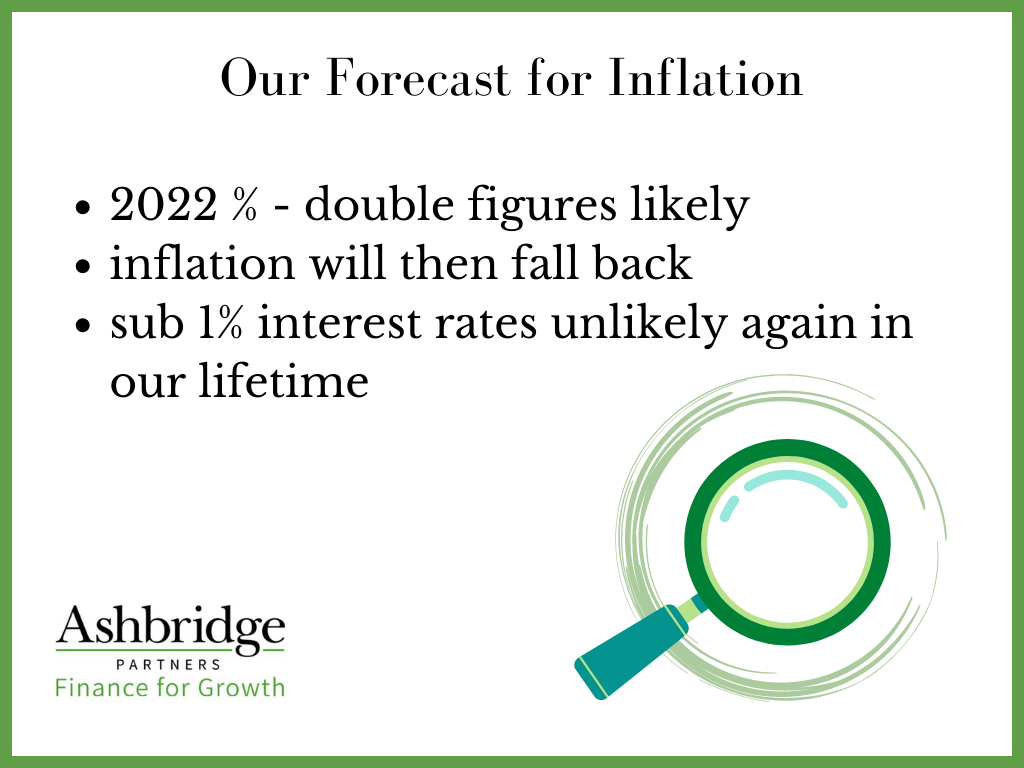

Can we use history to help us predict the future? Nothing is ever completely certain, but at Ashbridge, our prediction is that inflation is likely to peak later this year, then fall back albeit not to the low levels we have grown used to.

However, recent history should probably not be used as a guide to future rates. We’re unlikely to see sub 1% interest rates again in our lifetime.

New opportunities, informed decisions

We work with many successful entrepreneurs and business people, and experience tells us that a change in the environment always opens up new opportunities. Whatever the outcome of the next few months, we probably can’t influence it. It therefore makes good sense to focus on what we CAN do.

The trick is learning how to adapt and find the opportunities, rather than passively sitting frozen in fear. Avoid worrying about what is outside your control. Rather, identify your revised strategy, make informed decisions, find the right support, and implement your strategy with confidence.

Learning from the 1970s – inflation can be your friend

Let’s look again at the 1970s. Entrepreneurs optimistically sought out opportunities in a time of change, as most entrepreneurs do. Many property investors bucked the national trend and made their fortunes while the country queued for petrol. How did they do it?

They saw the silver lining behind the cloud, raised some debt, took a calculated risk, and invested wisely.

It may seem counter-intuitive to borrow in a time of high inflation. It feels protective to sit still and guard your assets. However, doing nothing could leave you worse off.

How could debt give you better long-term returns? Let’s look at two examples in theory and practice:

In Theory – A Tale of Two Scenarios

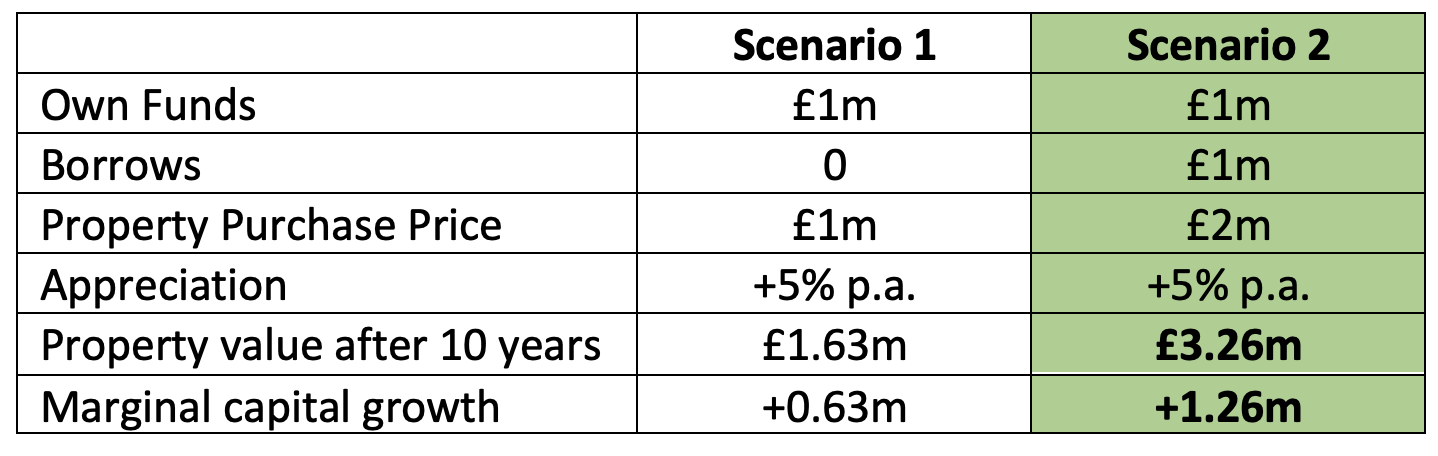

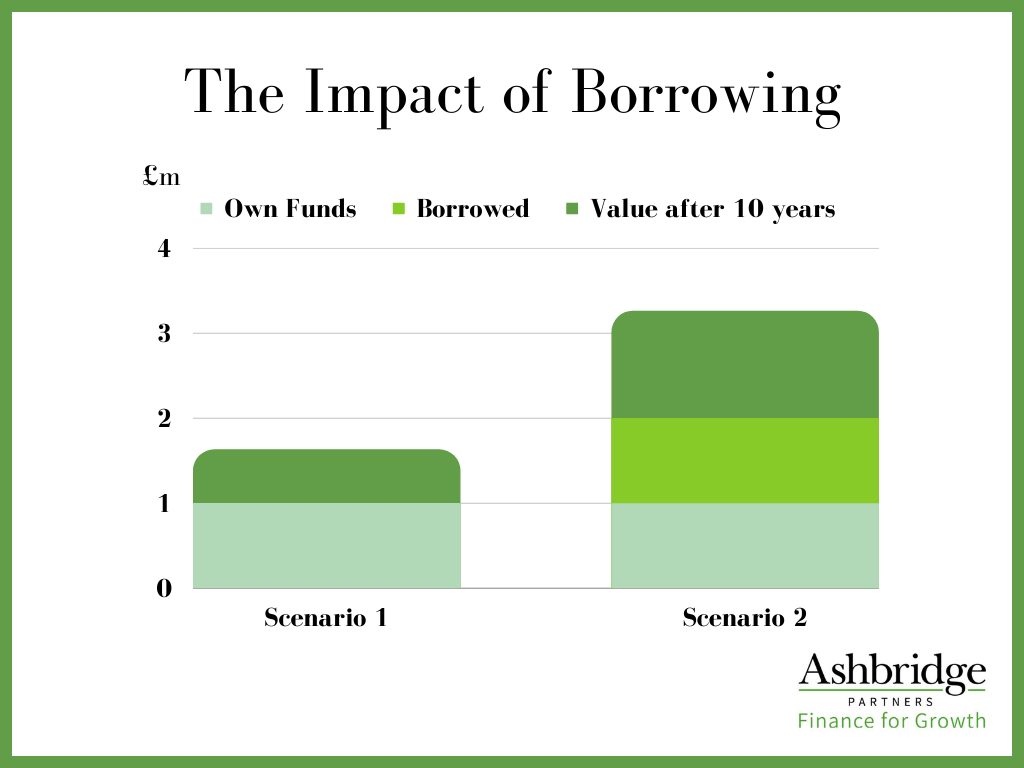

Let’s illustrate with two simple scenarios, using a property investor starting out with £1m.

Scenario 1

An investor has £1m to invest in rental property and purchases a £1m asset. The asset value appreciates by 5% per annum. At the end of 10 years it’s worth £1.63m and he has had the benefit of the income over the period. Without any debt, the property investor sees his asset appreciate by £630k in nominal terms.

Scenario 2

The same investor purchases a £2m property by borrowing £1m secured against that property. He has the benefit of having more asset exposed to the inflationary environment. Working on the same 5% annual asset inflation, his property would be worth £3.26m at the end of ten years. With 50% gearing, he has turbocharged his returns. Clearly, there are more risks associated with taking out the gearing but in an inflationary environment this can pay dividends.

In Practice – Client Case Study

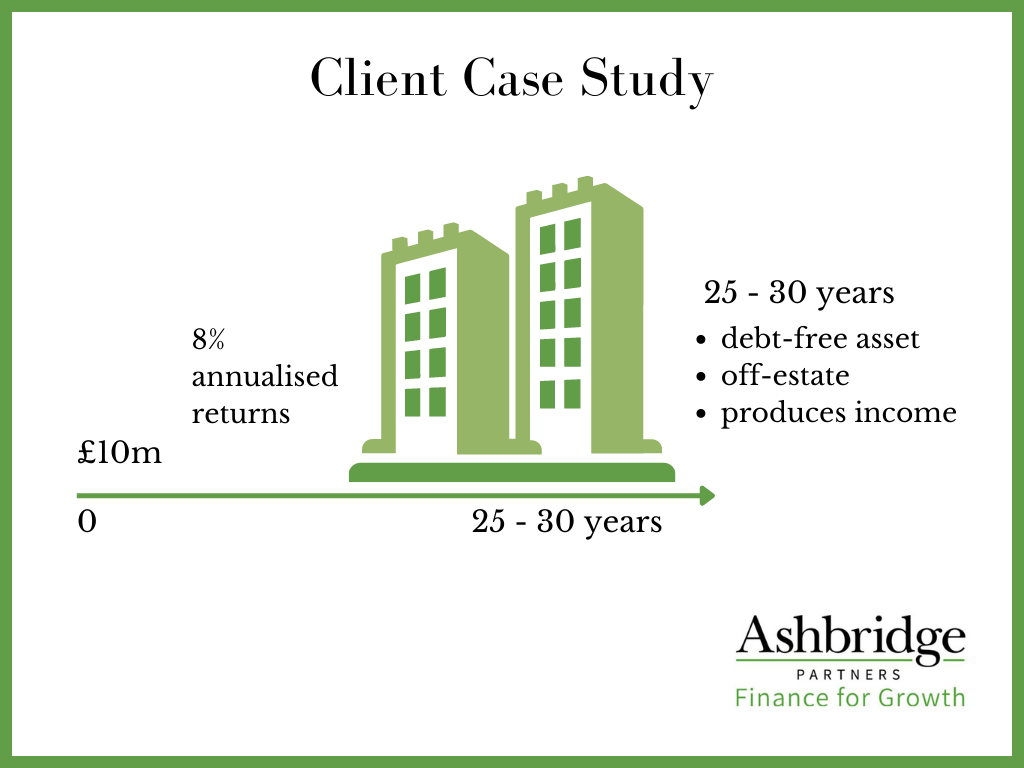

One of our clients, a landed estate family, was looking to increase their trading income. Through our support, they raised £10m to invest into off-estate commercial property. In effect, this investment was 100% debt financed.

Over the past five years this has produced annualised returns of 8%, along with significant capital gains when assets are traded. In turn, the 8% return is able to support the interest and capital repayments over a 25 or 30 year term. If they continue as planned, the end result will be a debt-free off-estate asset which produces an income.

This could never have been achieved had they not raised the debt. They may, in fact, have had to sell estate assets in order to buy the commercial property, something which would have impacted upon the estate’s integrity.

Ashbridge Partners – Finance for Growth

This heightened inflationary landscape will be new territory for many. We are receiving calls from several long-standing clients concerned about the impact of higher interest rates on their long-term strategy. The mainstream press may be taking a sensationalist approach to this story, but there are two sides to it.

We’ve provided sound advice for clients over many years, whatever the macro environment. We take each client’s individual scenario and present them with options so they can make well-informed choices over their debt structuring, and understand the financial implications.

Yes, the financial environment we have become accustomed to is changing. However, alongside the well-publicised challenges, there are also new opportunities.

Contact Us:

If you would like to discuss your own options, then please call us today.

Mark Ashbridge

01451 830223

07770 659553

mark@ashbridgepartners.co.uk